Secondhand marketplace: In South Korea, obtaining a used item through online platforms has been popular for the past few years but gained even bigger momentum since the pandemic. According to Job Korea’s survey in 2021, more than 75 per cent of consumers had purchased a secondhand item at least once. Platforms saw an influx of people looking for cheaper goods amidst the economic downturn and selling needless items for extra money.

However, the number of fraud damage cases also soared with the increase of users. Statista reported the number of cases in thousands rose from 161.09 in 2018 to 245.21 in 2020. Job Korea also found that secondhand market apps like Bungaejangter, Karrot, and Junggonara saw 704, 360, and 351 per cent increase in on-platform disputes, respectively, in 2021 compared to the previous year.

Early fraud cases included sending fake (or different items) and not providing promised exchanges. Scam watchdog platforms like The Cheat became more widely used, where people can register banking information or personal contacts of suspicious or malicious secondhand marketplace users. Several online banking apps started to display a pop-up screen when people try to send money to reported accounts on their system.

Knowing that surveillance and watchdog platforms over transactions have strengthened over time, some criminals are going beyond just vanishing after selling fake items — they are coming up with ways to fool users’ eyes, crafting fake secure payment systems.

Fake websites and overcharged transaction fees

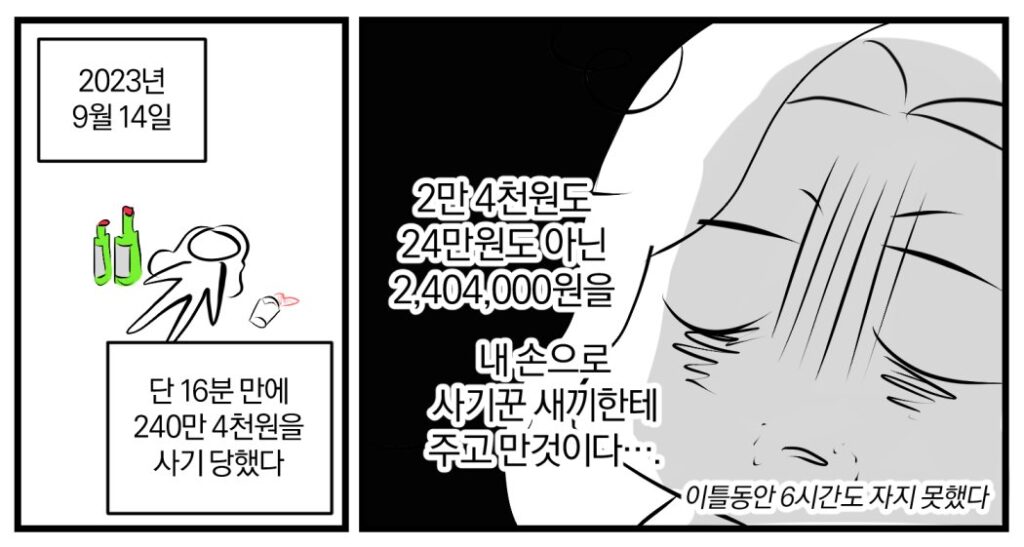

On 16 September, Nayang, a Korean webtoon artist, was scrolling through lists of items on Junggonara, the most-used secondhand marketplace platform in the country. There, she found a drawing tablet with a screen display up for 1.2 million won (US$ 885), which was less than half of its shop price.

“I visit secondhand marketplace platforms quite frequently,” Nayang told 4i Magazine in an interview done via email. “This time, I looked for a product not easily found on these platforms. I could not find it on Bungaejangter or Karrot, so paid a visit to Junggonara.”

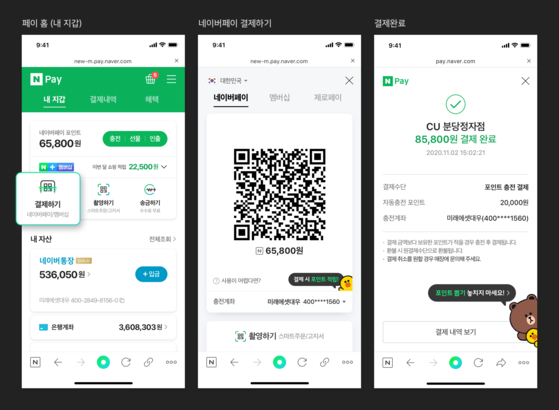

The seller said Nayang can send money through a secured payment system operated by Naver, the biggest search engine and online platform in South Korea. The tech giant runs a protected transaction system called Naver Pay; Naver mediates safe transactions by asking sellers to authenticate their personal information and deposits buyers’ money safely until they receive items through this system.

Feeling relieved that the seller wanted to do the transaction through a protected payment system, Nayang proceeded to the next step. The seller told her they had registered the drawing tablet on the system with its price and sent her the link to a fake website, a replica of Naver’s payment screen with the platform’s logos, and Google business ads.

Secondhand marketplaces

The only way to identify whether this website is fake or not is by taking a closer look at its URL. Unlike the real URL that starts with “https://”, which takes users to a secured connection, the fake website’s link does not have the letter “s” after “http”. In Nayang’s case, the malicious link included the name “Naver” twice.

Nayang, who felt drained and tired after her intense freelance work routine, missed these cues. She sent the full amount of money to the seller through the illicit website. The seller then asked Nayang to pay the same amount and the transaction fee again, saying that the fee was not paid during the first round of transactions. Being told that she would get the first pay refunded only when the second round of charges was done, Nayang transferred the money once again. When the seller asked for another round of transactions, she realised she was talking to a scammer.

“When it happened, I was so shocked that my mind went completely blank,” Nayang said. “It felt like someone else’s story, not mine, and my money would return soon. As time passed, I started to fault myself and feel terrible.”

Not the first time – secondhand marketplaces

Fraud cases using fake Naver Pay links on secondhand marketplaces seem to have emerged in 2022 and become more prevalent this year.

Between October and November 2022, more than 600 people contacted the police to report scammers using the self-built Naver Pay system. In April, Seocho District Police Station in Seoul, South Korea, received more than 50 reports from people who paid money for fraud on fake websites. Their damage ranged from hundreds of thousands to tens of millions, depending on the items they were buying.

The police said this type of scam can cause secondary damage if these scammers guide buyers to put their personal IDs, passwords, home addresses, and mobile phone numbers on the fake system they coded.

Although there could be more than hundreds or even thousands of victims of these scams, arresting scammers is not easy for the police as it is hard to track them down.

Many of these scammers do transactions on third-party bank accounts, not under their names. Bank account holders are also victims who had their personal information leaked to cyber criminals. What’s worse, the connections of these crimes are mostly outside of the country, requiring more time and effort to find exact locations.

Nayang said her case is still currently under police investigation, and she has not received a refund yet.

To curb fraud cases on secondhand marketplace platforms

According to the current Korean legal system, secondhand marketplace scams are not categorised under “telecommunications-based financial fraud”, unlike voice phishing frauds. Thus, banks can’t publicise information about suspicious bank accounts or practice any responsive actions against them without a police warrant. Reports say it usually takes seven to 10 days to suspend scam bank accounts, from filing a report with the police to issuing the warrant.

To get their money back, victims have to apply for an order of compensation. This can be applied only when scammers are found and caught. If scammers are not arrested, or they are found but unable to compensate for damage, victims might not request a refund.

Without legal protection, precautionary measures fall to individuals’ responsibility.

Nayang thinks that secondhand marketplace platforms should be able to establish their secure payment software within websites or apps and build a compensation system for victims. She adds that the law that states “telecommunications-based financial fraud” should extend to cases of secondhand market transactions.

“The government should impose stronger legal actions and more extensive investigation into secondhand market fraud cases,” Nayang said. “They should be treated on the same level as voice phishing cases with more priority than now.”

To raise awareness around such fraud cases, Nayang is drawing a series of cartoons about her own experience on Postype. The first episode has recorded more than 180,000 views as of today.

“Secondhand marketplace fraud cases happen around us, and perhaps it may occur at least once in your lifetime. What victims should remember is that it is not their fault that they experienced such damage. […] The fundamental guilt lies in the hands of those scammers, so victims should try not to blame themselves or feel hopeless,” Nayang said.