‘Cyber Week saw record sales’. The phrase is the same one we are accustomed to hearing from analysts because, year after year, Black Friday and Cyber Monday bring to a close a long period of promotions that distinguishes online shopping and sales in physical shops. The numbers are steadily growing; customers are happy to have found the items they wanted at the right price, and retailers are even happier because they have secured the highest seasonal revenues. Is everyone happy, then? Things are a bit more complicated than that because the lesson that the most eagerly awaited shopping event before Christmas has taught us is that the more online sales increase, the more sales in stores drop.

These are two sides of the same coin, as the ease and speed with which we can buy any product via smartphone (which speeds up the process even more than with a computer) have accustomed people to buying what they want when they want, regardless of place and time. Because online shopping never closes, promotions abound daily, and distance shopping has become routine. You don’t waste time going to the shop, you don’t consume petrol, you don’t have to look for parking for your car, you don’t have to walk. You don’t have to do anything except a few clicks to have the coveted product delivered. Which often costs even less than the price in a shop.

Online shopping, never-ending growth

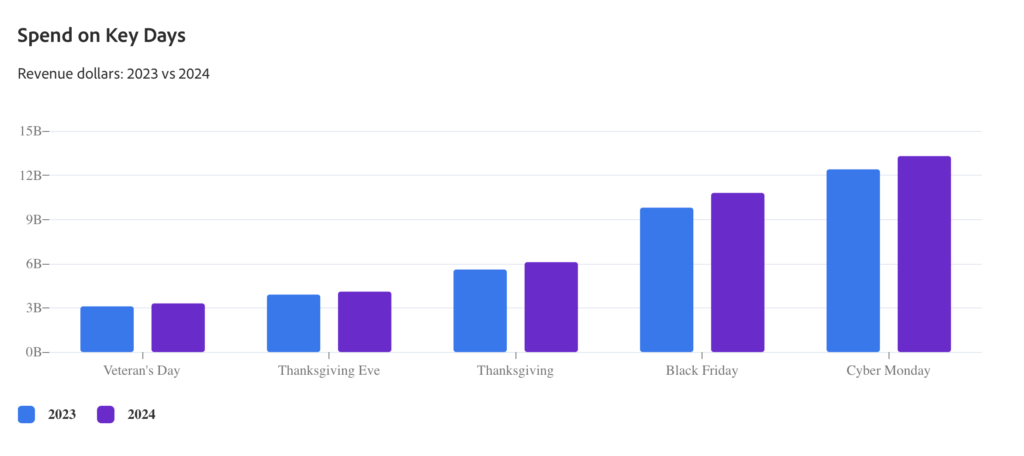

It sounds like the challenge between eBooks and digital books, between a world before and after the internet. Or rather, it doesn’t just seem; it is like that. It is normal for generations born in the digital age to prefer to do everything with a smartphone instead of following the old habits of their parents and grandparents. This process explains the doubling of revenues recorded during Black Friday over the past seven years. In 2017, US consumers had spent around $5 billion on online purchases. On the last post-Thanksgiving Friday, on the other hand, according to Adobe Analytics, total transactions completed on eCommerce platforms amounted to $10.8 billion, a 10.2% increase over 2023.

A monstrous number? This is not so if you compare it to what happened three days ago, during Cyber Monday: in 24 hours, Americans spent $13.3 billion, up 7.3% on the previous year, according to an analysis by Adobe Analytics, which tracks online purchases. During the two busiest evening hours, $15.8 million purchases were made every 60 seconds. To close the loop, it’s worth doing the math on Cyber Week revenues, which starts on Thanksgiving and ends with Cyber Monday: $41.1 billion over five days.

‘Year-on-year growth was stronger on both Thanksgiving and Black Friday, however Cyber Monday remained the biggest online shopping day of the year,’ said Vivek Pandya, chief analyst at Adobe Digital Insights. ‘Retailers’ early discounts encouraged people to buy earlier this year and Cyber Monday became a kind of last call for Christmas deals,’ Pandya added. Confirming the dominance of Cyber Monday is the amount of money spent on a global scale, which, according to Salesforce, reached $49.7 billion, up 3% compared to the previous twelve months.

Trends driving eCommerce purchases

Going beyond the figures, it is useful to investigate what drives people to concentrate on their purchases during a few specific days. Obviously, everything revolves around price, with markdowns also attracting people to products not considered but considered convenient thanks to discounts. But there are other variables, such as the payment method. The ‘Buy now, pay later’ has encouraged a surge in shopping, contributing in the US market $686.3 million in spending during Black Friday (+8.8% on last year) and close to $1 billion during Cyber Monday. The deferred payment option is very popular with smartphone shoppers and younger people because it combines execution speed with the security of not spending money instantly.

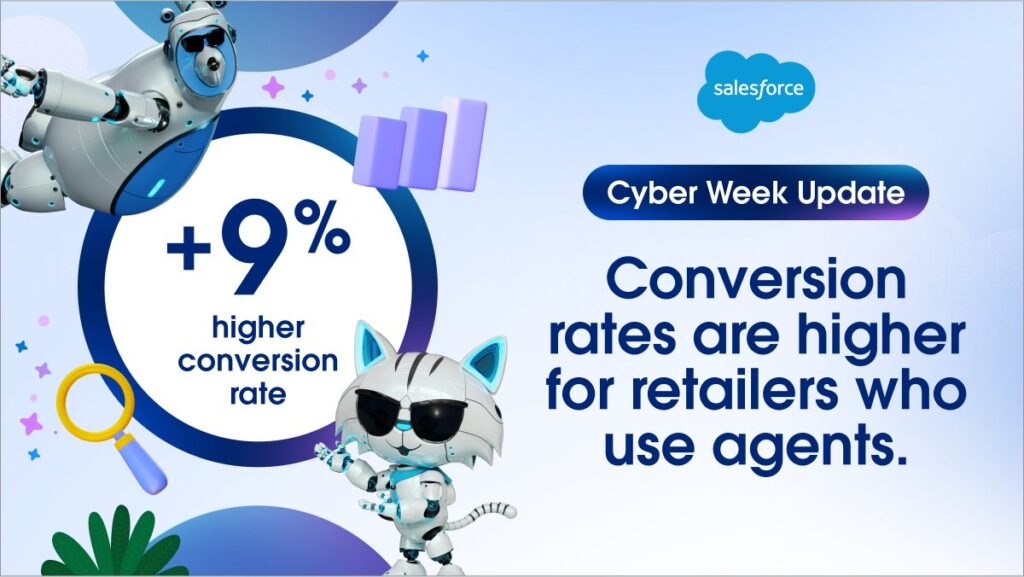

Another variable worth mentioning is AI, specifically chatbots, with bots guiding clicks to sales sites. Useful for locating offers, finding products and brand recommendations, GenAI-based software has favoured companies that have focused on innovation, with retailers achieving a 9% higher conversion rate than their peers who deferred the experiment, according to Salesforce. ‘For an industry often worried about margins, especially in view of rising costs in 2025, this increase is a game changer,’ said Caila Schwartz, Director of Consumer Insights at Salesforce. Although, I remain convinced that one must take all statements of grandeur about AI with caution, given that they almost always come from companies that have invested so much money in the evolution of GenAI.

Mobile, buy now and pay later AI, and chatbots are the bright spots of the present and the future, the foundation for the growth prospects of online shopping for the coming Black Friday and Cyber Monday.