A step forward for Europe, which is counting on the Singapore company to catch up with Asia and the USA in chip production

Silicon Box, a Singaporean company specialising in advanced semiconductor packaging and chiplet integration services, will build a chip factory in Novara, Northern Italy. The investment will be €3.2 billion, with around 1,600 new jobs created when the factory is fully operational, plus those derived from the construction of the factory and for dedicated supplies. Put like that, it sounds like excellent news for Italy and Europe, which are interested in making up the gap in chip production that separates them from Asia and the United States to gain more independence for the digital and ecological transition.

In Italy, the announcement was greeted with great fanfare, with the governor of the Piedmont region even speaking of a ‘project that represents the first step of the Italian Silicon Valley‘. The enthusiasm for a project that is part of the Italian plan to promote the electronics industry is undeniable. Novara has won the internal challenge against Veneto, which had proposed the Vigasio site as the centre for developing a future Italian innovation hub. However, some aspects need to be clarified to understand the choice of Silicon Box fully.

Italy’s money

The first is predictable and concerns state intervention. As always, when it comes to companies active in strategic market segments on the hunt for a new place to build a factory, the race is on for the concessions different countries provide. In this case, the €3.2 billion plan envisages the Italian government covering just under 40% of the budget, as said by the Minister of Enterprise and Made in Italy, Adolfo Urso.

Prior to the official start of work, authorisation from the European Commission is required. However, this seems to be a formality precisely because of the Old Continent’s need to speed up chip production. The rewarding aspect for Italy, particularly for the northern part of the country, is its geographical location: at the centre of Europe, well connected with other countries and covered by an effective transport network, with trains, motorways, airports and commercial ports allowing rapid transfers.

Silicon Box, what they do and why it matters

Founded in 2021 by Sehat Sutardja and Weili Dai, figures with many years of experience in semiconductor design and packaging after having led the Marvell Technology Group, Silicon Box also counts among its strongmen CEO Byung Joon Han, who for two decades headed Stats ChipPAC. To get an idea of their vision and capacity for action, it is enough to know that Sutardja and Han have more than 800 patents in the USA to their credit, demonstrating a fruitful 20-year collaboration.

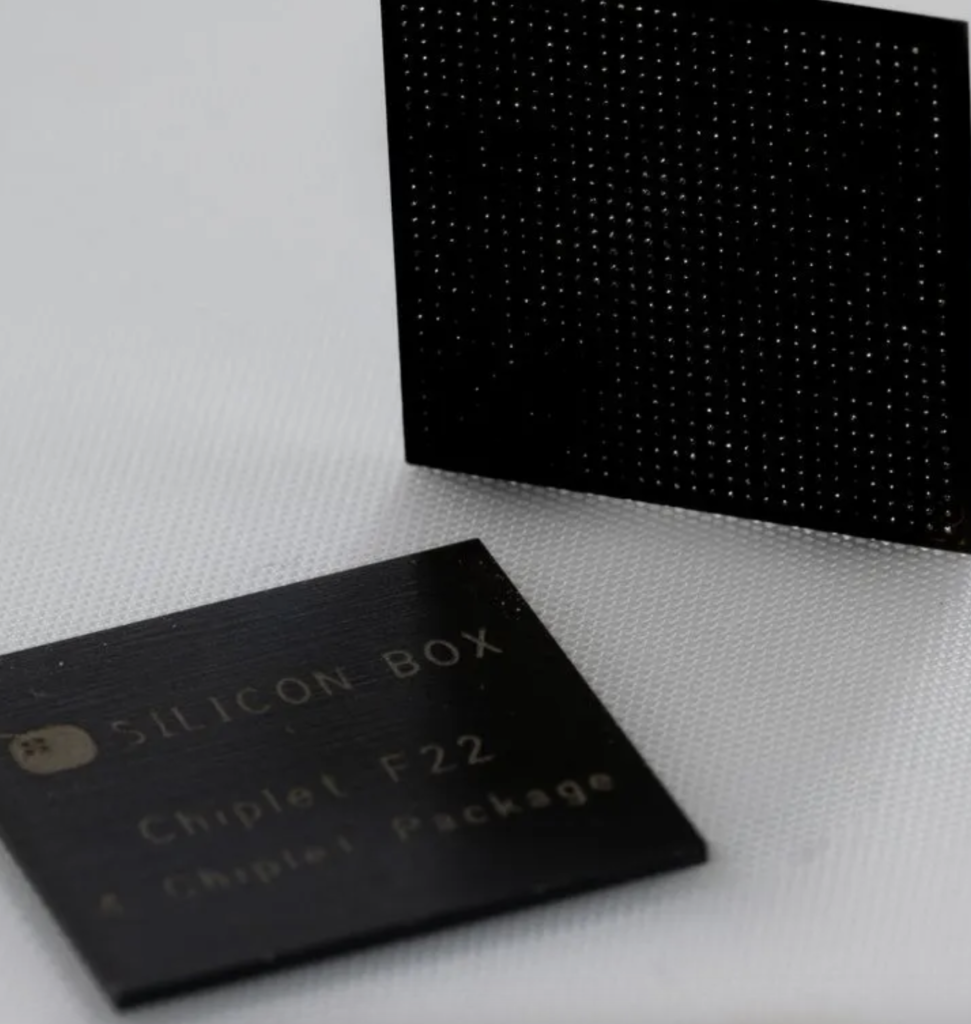

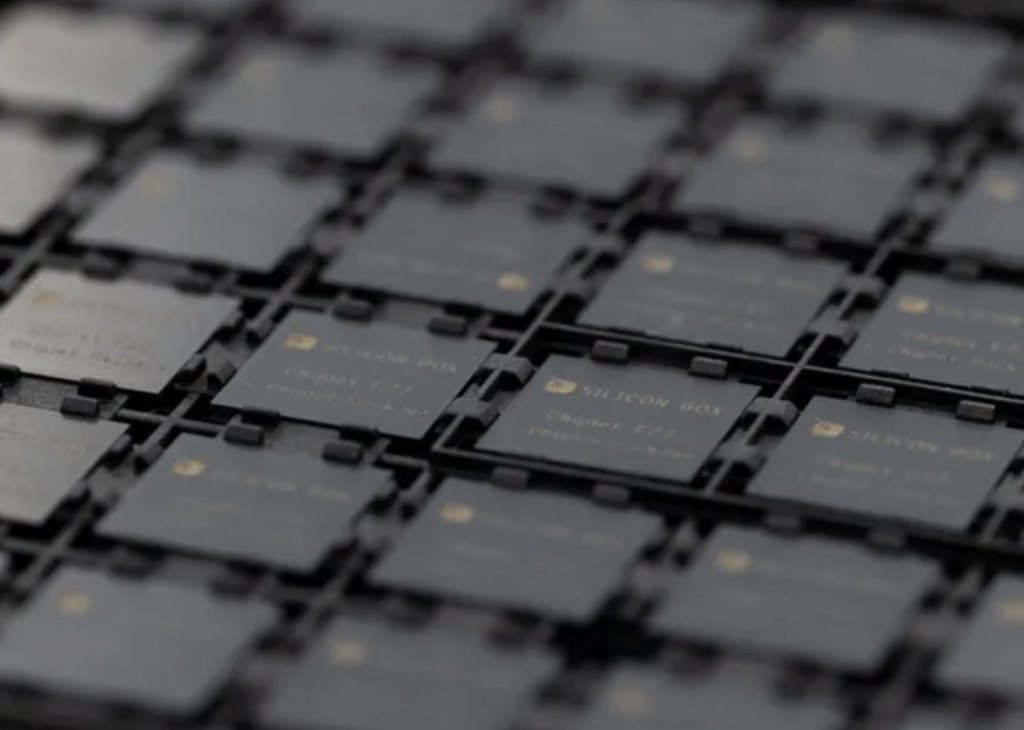

With a 73,000-square-metre factory in Tampines (Singapore) that integrates autonomous power, water and gas plants, Silicon Box has carved out a leading role for itself in chip production thanks to its method for interconnecting chiplets that maximises performance and eliminates bottlenecks. It does not produce chips but takes care of their final stage: testing and packaging.

The company recently closed a $200 million Series B round, with the participation of the three co-founders and a long list of investors: BRV Capital, Event Horizon Capital, Grandfull Convergence Fund, Hillhouse Capital, Lam Capital, the corporate venture arm of Lam Research, Maverick Capital, Prasedium Capital, Tata Electronics, TDK Ventures and UMC Capital.

A science and technology hub for Italy

The arrival in Europe is a good sign, not least because chiplets are one of the basic building blocks to enable applications related to artificial intelligence, as well as being used in smartphones, washing machines and many other devices we use every day. Construction of the Italian factory, which will rise in Agognate, near the Milan-Turin motorway, is scheduled for mid-2025, with production starting in 2028.

“We worked for 10 months on our candidacy dossier and the choice of Silicon Box initiates a paradigm shift for the future development of Novara and north-eastern Piedmont, with the birth of a science and technology hub and an innovation district for which the new semiconductor production will be central and whose role will include carrying out additional tasks related to the technological, territorial and economic environment that the new factory will create around it,” said Alessandro Canelli, mayor of Novara.

Too early for glory

The Singaporean company’s investment is part of the European strategy based on the Chips Act, whose goal is to double the global market share in semiconductors by 2030, from 10% to 20%. But it is also a significant step forward for Italy, which in recent weeks received the announcement of a €5 billion investment by STMicroelectronics, which is interested in upgrading its Catania (Sicily) production site, where chips necessary for the production of electric cars will be manufactured.

All very well, then. Provided that Silicon Box’s plan will be implemented and not cancelled, as happened with Intel, which had planned investments of €4.5 billion to build a chip factory before changing direction and focusing on Germany and Poland. Rewarded for putting more funds on the table and the ability to meet commitments and deadlines with foreign partners. Intel’s precedent is too recent to launch into immediate dreams of glory. Before toasting, it is better to wait for the start of work and then the completion of the factory.