A second life to revive itself after the huge difficulties of transitioning from mobile phones to smartphones. Having vanished the nightmare of a demise that befell several other brands, Motorola saw the sun again when it came under the leadership of Lenovo. The Chinese multinational acquired Motorola Mobility from Google in 2014 for $2.91 billion and, over time, found solutions to bring a historic brand back to life.

Apart from making the first voice call from a wireless phone in April 1973, Motorola was one of the queens in the mobile phone market and, with its ‘M’ on the back of today’s smartphones, is still a very recognisable company for consumers over 40. On the other hand, it has long been unknown to younger digital natives in a market dominated by Apple and Samsung. It has, therefore, had to face a renaissance to show itself to the segment of the public that today determines most purchases in the sector.

The Italian Job

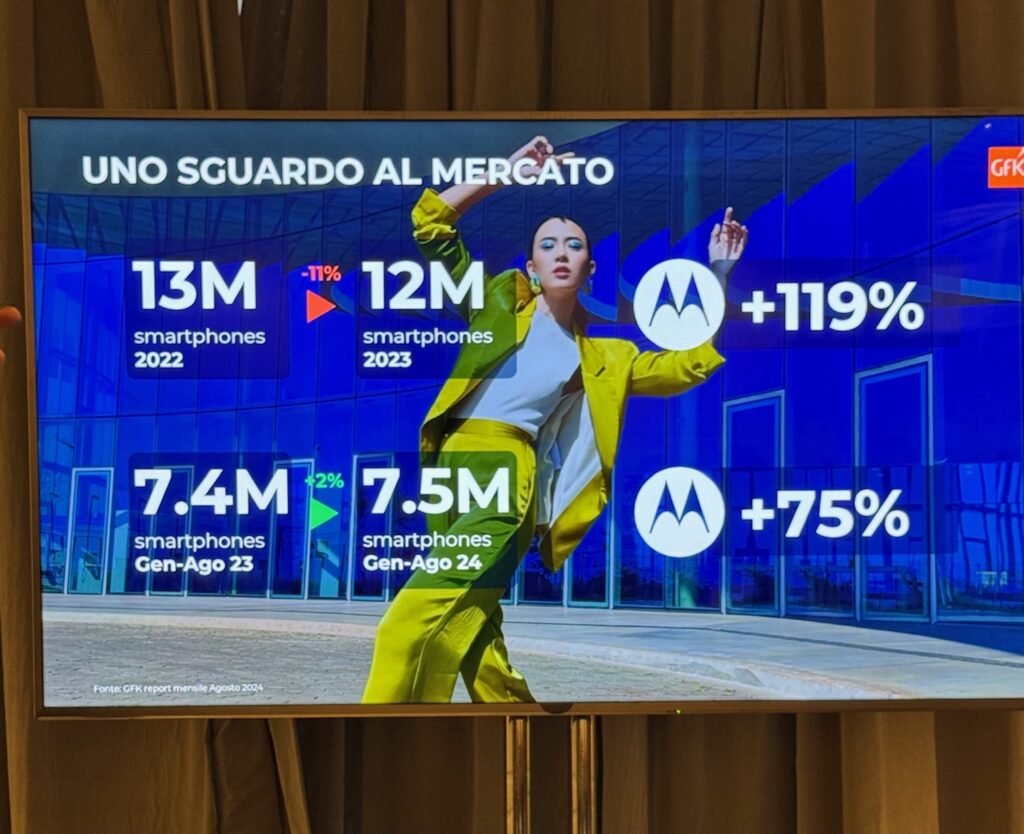

Very strong in South America and growing in North America, Motorola is also making inroads into European markets, except Italy. In this country, it shines the brightest. The numbers explain the situation. In 2023, the Italian market closed with an 11% drop from 13 million to 12 million units sold, with Motorola growing by 119% instead. In the first eight months of 2024, smartphones sold in Italy were the same as in the previous period (+2%), but Motorola rose by 75%. These figures gave Motorola a share of more than 13% in the third quarter of this year (source: GFK), allowing it to become the third Android manufacturer, just a short distance from second place.

The increase in sales volume is mainly due to the cheaper models, with a price range of up to €300. However, the growth is increasing sales and visibility of all the brand’s smartphone families, with the company itself clarifying the trend of its product mix, which is shifting towards higher price ranges in 2024: 9% for the Razr and Edge ranges, 70% for Moto G, which recorded increases of 27% compared to the same period last year, and 21% for the low-end represented by the Moto E family.

Motorola

Having observed Motorola Italia’s path from the beginning, it is fair to give the team credit for having succeeded in diversifying the products in its portfolio and having found many effective partnerships to get closer to the younger generation. The decision to bet on sport was excellent, with sponsorships in football (Monza), basketball (Pallacanestro Varese, as well as Euroleague and Chicago Bulls), volleyball (Busto Arsizio), as well as Ducati and Formula 1 in motorsport. On the other hand, targeting several music events also proved to be a far-sighted move to give visibility to brands and products.

On the technical side, Motorola dared and was rewarded by the choice of unusual materials, such as wood, and by partnerships such as the one with Pantone to launch smartphones with exclusive colours, impossible to think of until a few years ago, when phones were only white or black. More than anything else, however, Motorola’s rise is due to Lenovo, a leader in the computer market, which has provided substantial investment for long-term projects.

The Motorola family

The confirmation comes from Carlo Barlocco, Executive Director & General Manager Motorola Italia, a tech industry veteran, previously the architect of Samsung’s Italian exploit in the smartphone market. ‘Our strength lies in being part of a large ICT group, from which we inherit a certification of reliability that allows us to propose ourselves as a privileged interlocutor even in the B2B world. It is no coincidence that in the last period, we have won many tenders from companies that rely on Motorola devices, thanks precisely to the effectiveness of Lenovo devices. Being in the same group means they know they will have the same advantages.

Motorola is building its ecosystem as much as the core business is smartphones. ‘We are working on getting the consumer used to being within the Motorola family. We started with the Moto Buds and Buds+ with Bose, a quality product at an affordable price, then came the Moto Tag Bluetooth locator for finding personal items, and soon a wearable will arrive that will attempt to stand out in a market segment where there is so much supply but also so much standardisation,’ Barlocco said.

Foldable smartphones

On the other hand, those who have yet to take off are foldable smartphones, which have so far failed to meet expectations. ‘We are satisfied with our Razr, which is selling and everyone likes it, but the market is suffering from price limitations. Spending €700–€800, which is the cost of some foldables on promotion, is a major barrier for many people. Dropping below 500 euro could turn the category around, provided the quality of the product is not reduced’.

Barlocco also has clear ideas on the future of generative artificial intelligence, which is still limited in terms of function and effectiveness. ‘We are now in an embryonic phase with a standard that is no longer so distinctive, with Microsoft on one side and Google on the other. We will work with both and in synergy with Lenovo to develop a synchronisation between smartphones and PCs. At a general level, the turning point will come when the person no longer has to ask for help from the device, but rather, the smartphone and computer will suggest what to do, fulfilling the user’s requests. This will be the step that will change everything, perhaps even transforming the form of the smartphone.