Unlocking the secrets of online banking security: How banks protect your information

Banking online can feel like a risky proposition. Not only do you have to worry about hackers getting access to your financial information, but you also have to worry about the security of the banking system itself. Thankfully, banks are taking more proactive steps to secure your financial information. From encryption and firewalls to different meanings of authentication, let’s look at the new technologies and cyber strategies banks use to safeguard our sensitive data.

Encryption

Encryption is one of the primary methods banks use to protect our data. Encryption is encoding data or messages so only authorized parties can read them. In other words, it is a security measure to prevent unauthorized access to sensitive information. Banks use encryption to protect your financial data when it is transmitted online. The data is encrypted before it is sent, so even if a third party intercepts it, they cannot read it.

The data is also encrypted when you log into your online banking account. This means that even if someone were to gain access to your account, they would not be able to access your financial data. Banks also use encryption when sending you emails or text messages with financial information, ensuring that your data remains secure even when sent over the internet.

Multi-Factor authentication

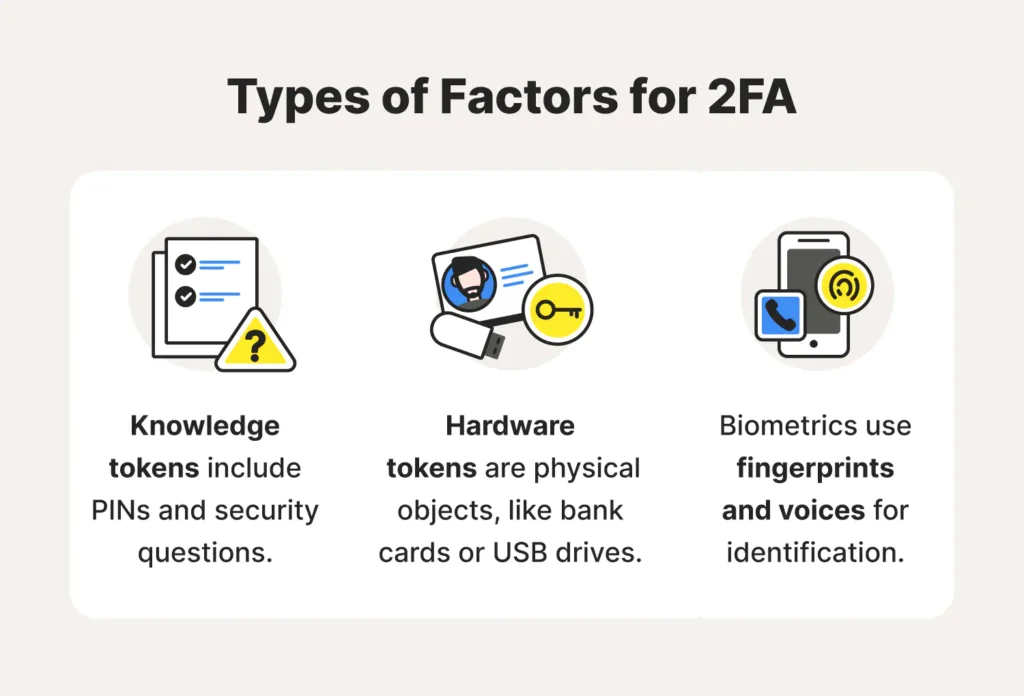

Multi-factor authentication (MFA) is another security measure that banks use to ensure user safety, which requires you to provide two or more pieces of evidence to prove your identity. This could include a combination of something you know (a password), something you have (a smartphone), and something you are (a fingerprint). Banks use MFA to ensure that only the right person can access your financial information.

MFA makes it much harder for hackers to gain access to your account. Even if a hacker were to get your password, they would still need access to your phone or your fingerprint to gain access to your account. This makes it much harder for them to access your financial data.

Firewalls and Antivirus software detecting external threat

Banks also use various other measures to protect your financial data from external threats. These measures include firewalls, antivirus software, and intrusion-detection systems. A firewall is a network security system that monitors and controls the incoming and outgoing network traffic based on predetermined security rules. This ensures that only authorized users can access the bank’s network, preventing any malicious traffic from entering the system. Antivirus software on the other hand scan bank’s information systems for malicious software, such as viruses and malware, which can be used to access the bank’s information system.

Banks also use two-factor authentication (2FA) to protect your financial data. This requires you to provide two pieces of evidence, such as a password and a one-time code sent to your phone, to gain access to your account. This method makes it much harder for a hacker to access your account.

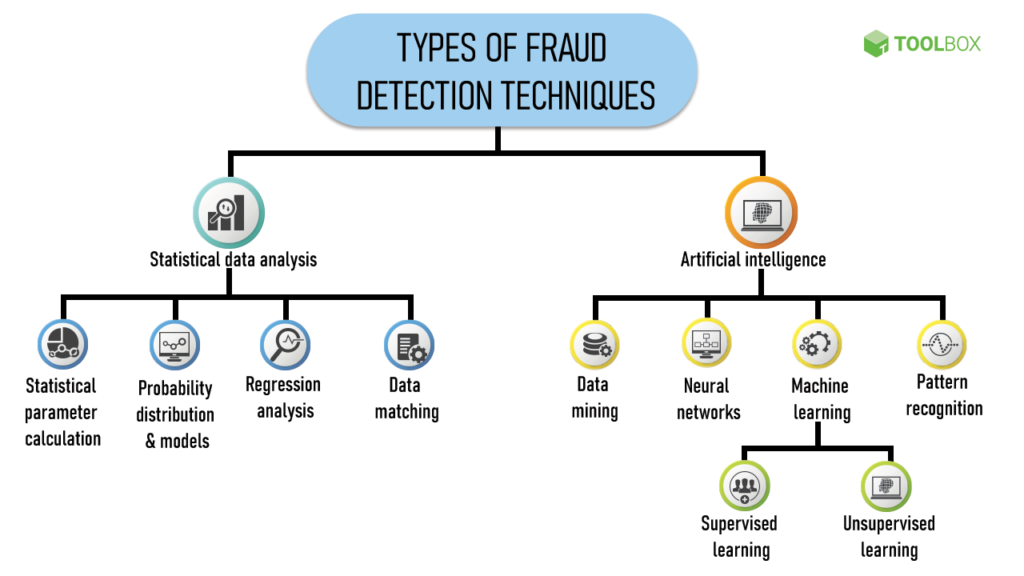

Fraud Detection Systems to detect suspicious activity

Another approach that banks use is fraud detection systems used to detect any suspicious activity. These systems monitor your account for unusual activity, such as large purchases or transfers to unfamiliar accounts. If the system detects any suspicious activity, it will alert the bank, and they can take action to prevent further losses.

The fraud detection systems also monitor for any suspicious login attempts. Suppose someone tries to log into your account from an unfamiliar location. In that case, the bank’s security team is immediately alerted, and they can mitigate the threat before it causes any damage.

Banks today are going towards AI-powered systems to detect and prevent fraudulent activities in real time. These systems use machine learning algorithms to analyze vast amounts of data and identify patterns that indicate fraudulent behaviour. For example, suppose a user suddenly makes a large purchase in a foreign country. In that case, the system may flag it as potentially fraudulent and require additional verification before allowing the transaction to proceed.

Using strong passwords for authentication

Having a strong password is crucial for online banking security. Banks require their users to have implemented strong passwords on all online accounts. A strong password should be at least eight characters long and contain a mix of numbers, letters, and symbols to be considered strong. It should also be unique, meaning it should not be the same as any other passwords you use.

That is why using a different password for each business account is also important, as this reduces the risk of a hacker gaining access to all of your accounts with just one password. It would be best if you also changed your passwords regularly, as this increases the level of safety since it will make it harder for hackers to try to guess the correct password.

What to do if you suspect a security breach

If you suspect a security breach on your bank accounts, you should first contact your bank immediately. Most banks have a dedicated customer service line that you can call to report suspected fraudulent activity on your account. They will likely ask you to provide information about the suspicious activity, such as the date, time, amount of the transaction, and any other relevant details. Depending on the severity of the situation, they may temporarily freeze your account or issue you a new card or account number.

Monitoring your account activity regularly for any unusual transactions is also a good idea. Most banks provide online or mobile banking services that allow you to check your account activity in real time. If you notice any unauthorized transactions, report them to your bank immediately. Finally, be vigilant about phishing scams and other fraudulent activities. Cybercriminals often use email, text messages, or phone calls to trick people into giving away their account information. Never share your account information or personal details with anyone you do not trust, and always double-check the authenticity of any communication you receive from your bank.

In conclusion, even though banks employ state-of-the-art technologies to keep our personal and financial information safe, we must remember that we, as users, also have a role to play in protecting our data. It is crucial to be vigilant and cautious when using online banking services and to follow best practices such as choosing strong passwords, regularly monitoring account activity, and being aware of phishing scams. By working with our banks and protecting our data, we can ensure a safe and secure online banking experience for everyone.