Only they make big profits from the top of the range

Fewer smartphones are being sold, but Apple and Samsung continue to increase profits, unlike other global manufacturers. There is no shakeup in the smartphone market, where even though there are many trying to enter the higher end of the industry, in the end, it remains the two companies that drive the market. So say the numbers, especially those involving sales of models above $500, where the gains for manufacturers are most significant. According to Canalys data for the first quarter of 2023, Apple dominates the best-selling smartphone ranking with six models in the top ten, while it is all Samsung Galaxy, the other four most popular phones among the public. Widening the range to the top 15 models; moreover, only two are phones from different companies: the Xiaomi 13 and Huawei Mate 50, which appear in 13th and 14th place.

The strength of the ecosystem

This ranking indicates how Apple and Samsung play different games as the only ones able to convince people to spend more than a thousand euros to buy a new smartphone with good regularity. This is a result due to a concatenation of factors because while the quality of materials, appreciation for design and the value of cameras and related technologies (as well as for Xiaomi, Huawei, Oppo, Vivo and Motorola) are undoubted, the Apple-Samsung pairing makes up the difference with a complete ecosystem that is a relevant advantage for many professionals. Added to this is an after-sales service that is widespread and generally quick to solve customer problems, not to mention, of course, the substantial marketing investments that contribute in terms of visibility and persuasion to purchase and that, in Samsung’s case, have enabled it in the past to carve a furrow with other Android manufacturers.

The strength of duopoly is very strong, so much so that even though globally, the smartphone market declined by 13.3% in the first three months of this year compared to the previous twelve months, the segment that includes models costing $500 or more had sales growing by 4.7% in the same period. Speaking of market share, the segment’s weight continues to increase: in 2020, it was 22%; in the following year, it was 25%; in 2022, it was 27%; and in the first quarter of 2023, it rose to 31%. This means that either sales of the most expensive models have increased or there has been a contraction of the other market segments. Whatever the trend, perhaps both are true; the figure gives insight into how consumers’ relationship with the smartphone changes, keeping in mind that the foldable option must also be included later.

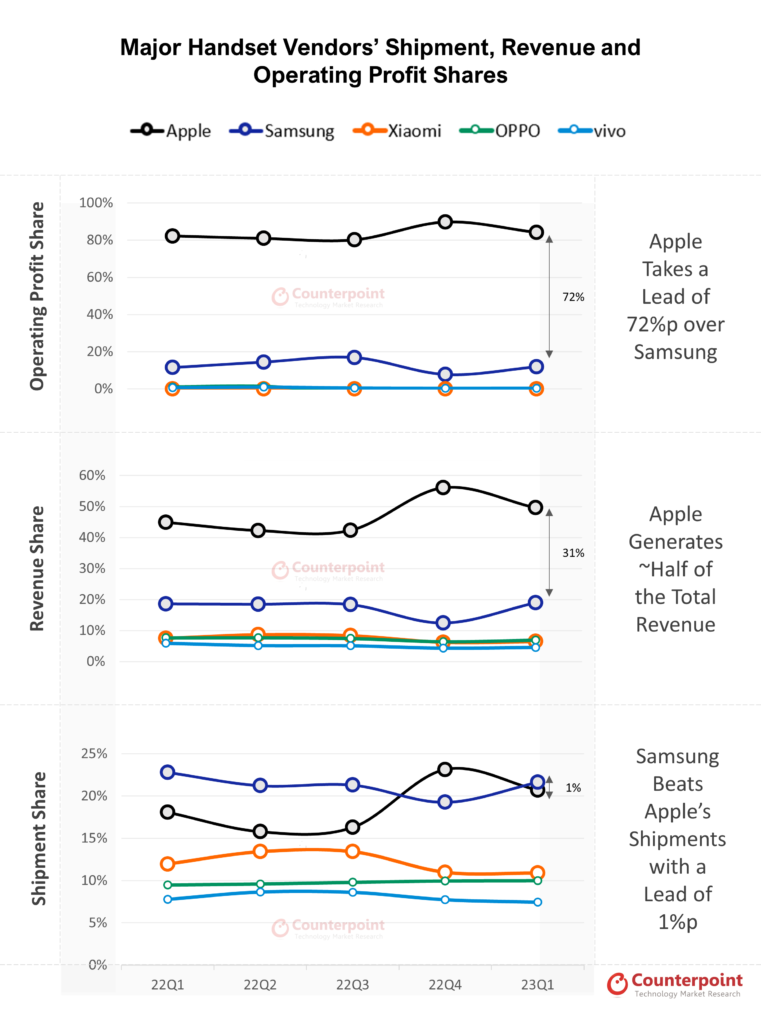

The duopoly gets almost everything

Going into the concrete, the supremacy of Apple and Samsung becomes evident when analyzing the profits secured by their respective smartphones. The benchmarks for January-March 2023 are iPhone 14 Pro with all its variants and Galaxy S23 with its three versions. The two companies secured 96% of the profits for the period under consideration, leaving the crumbs to Xiaomi, Vivo and Oppo, which each earned 1% of the total profit, according to Counterpoint data.

Samsung’s case explains well how the market is going because shipments for the Korean company are down 19% compared to last year’s period. Despite this, however, thanks to the Galaxy S23 series, the company increased its Average Selling Price to $340, +17% year-on-year and +35% quarter-on-quarter. It should be noted that Samsung shipped 60.6 million units in the first quarter. At the same time, those distributed by Xiaomi, Oppo, and Vivo in the same period totalled about 80 million units, with a total profit of 4%. That is why those who want to break into the Apple-Samsung duopoly are obliged to work hard and long, which may bear fruit only years later.