Green Economy: The European Union has set ambitious targets for climate change mitigation and a sustainable future. The Paris Agreement was the first universal, legally binding global climate change agreement, which, by limiting global emissions, aimed at keeping temperature increase or global warming well below 2 degrees Celsius compared to pre-industrial levels. It was adopted by 196 Parties at COP 21 in Paris on 12 December 2015 and entered into force on 4 November 2016.

The European Green Deal was then prepared by the European Commission and officially presented in 2019, delivering a set of policy initiatives to reach a net zero emission economy by 2050. The policy areas include clean energy, sustainable industry, sustainable finance, building and renovation, sustainable food production, pollution prevention, sustainable mobility, and biodiversity protection.

On the way? – Green Economy

The policy initiatives attracted criticism because ExxonMobil significantly impacted the early negotiations. Many member states and non-governmental organizations claim that the deal is not drastic enough and will fail to slow down climate change. And although, between 2016 and 2018, sustainable investment grew by 34%, and the average quarterly inflow of investment into sustainable funds grew from an average of $25 bn in 2018 to more than $85 bn in 2020, the influx of sustainable investment is considerably lower than what is needed to achieve the climate and sustainability objectives.

Questions arise

However, specific questions still need to be clarified with all these goals and investments. What is sustainability for a company? Who defines it and the plans necessary within an organization to achieve climate change-related objectives?

Furthermore, different sustainability and ESG frameworks are created by highly respected agencies, such as the UNPRI, World Bank, TCFD, and GRI. Which framework should be adopted by companies?

EU taxonomy

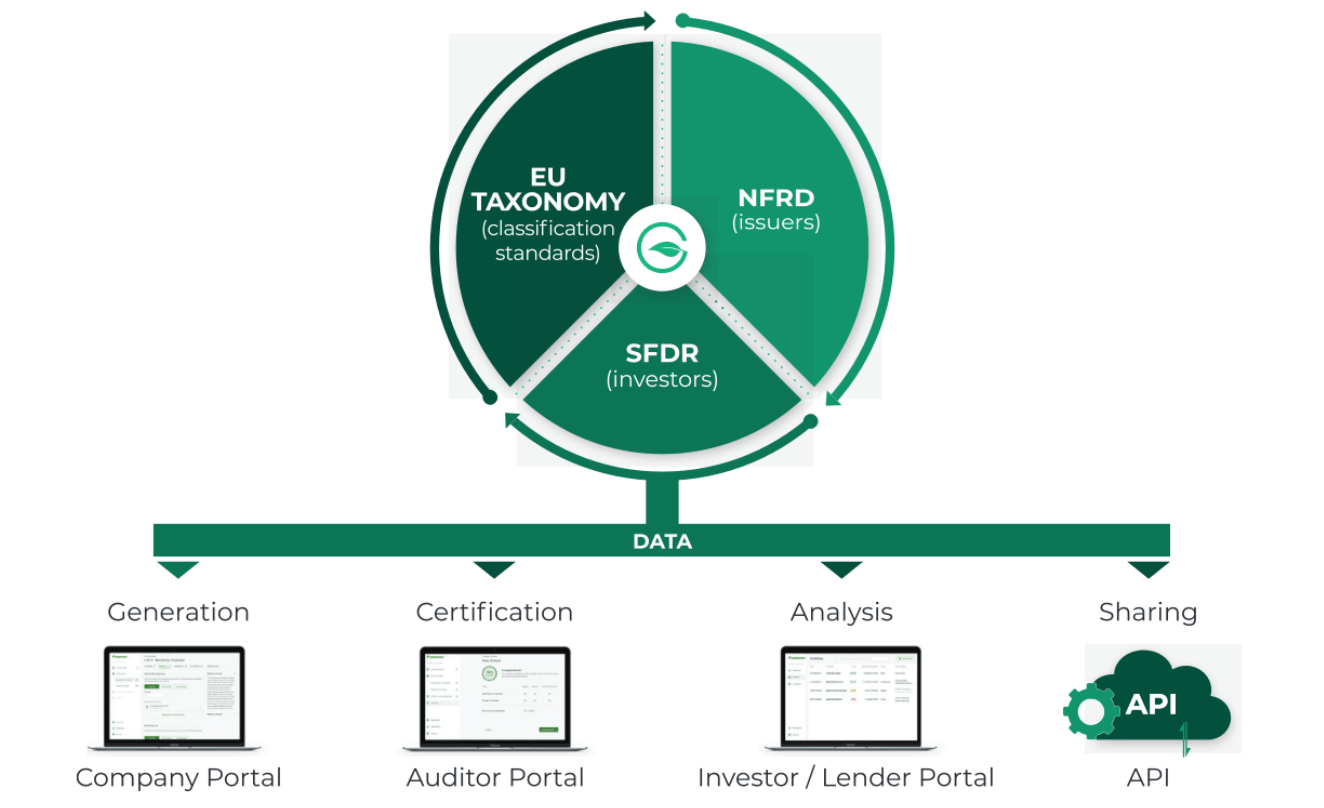

The EU, recognizing this problem, is the first jurisdiction to implement an ESG taxonomy, which provides a standard methodology to identify which activities and investments can be considered sustainable.

The Taxonomy is a common language that will enable companies, investors, and all impacted stakeholders to improve the coordination of decisions and investments required to achieve the EU targets for sustainable growth and a net zero carbon economy by 2050.

Who needs to comply? What are the challenges?

All the companies in the EU with more than 500 employees, banks and insurance companies, and companies that are defined as public-interest entities.

In the EU alone, the Taxonomy will create a sudden rush by 17.000 EU companies to capture and disclose company-level ESG data when it becomes mandatory in 2022.

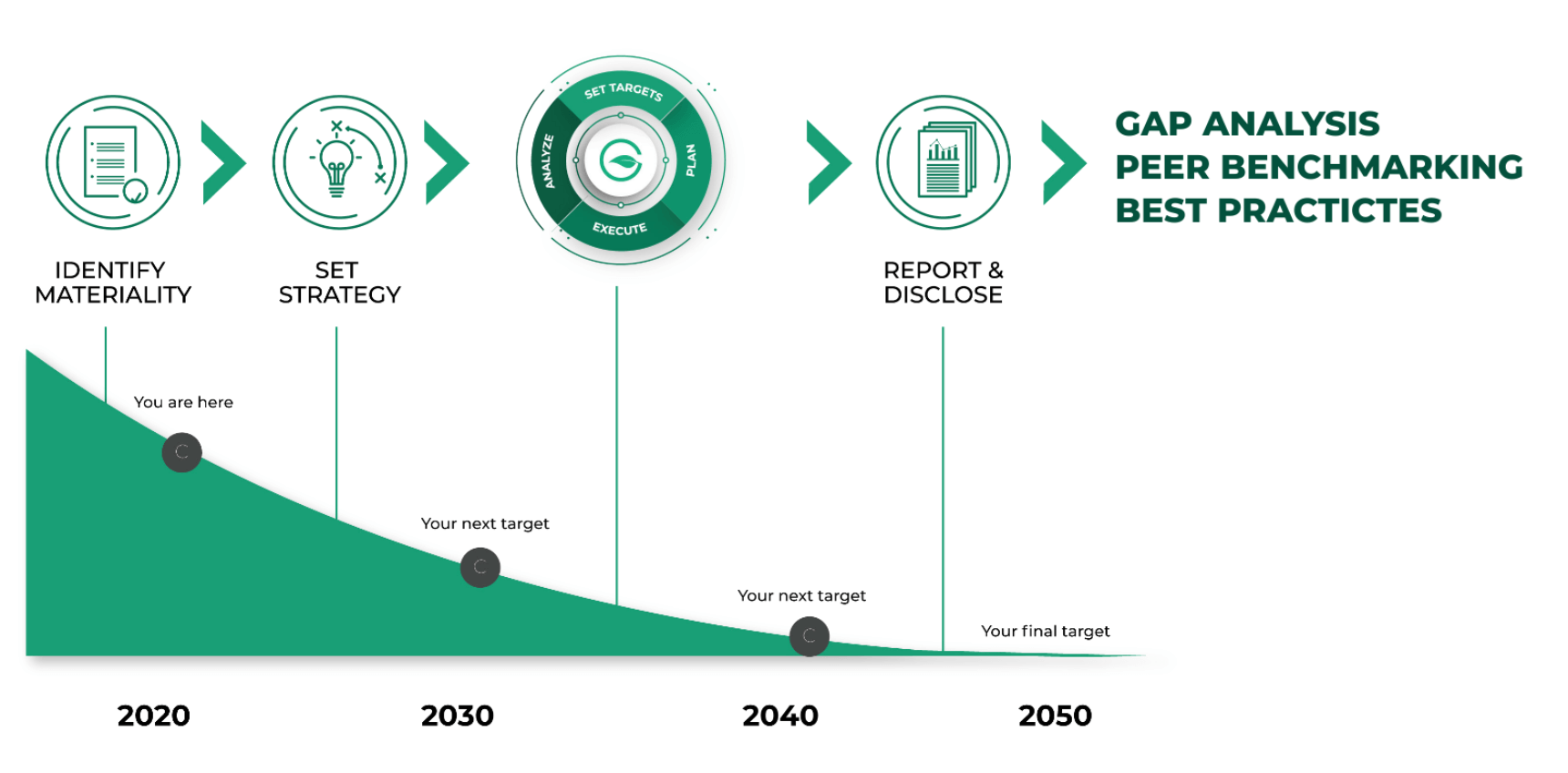

Greenomy was born to provide companies with software for a smooth transition and better data management. Greenomy’s solution helps companies and financial institutions with their sustainability reporting processes.

Greenomy’s mission – Green Economy

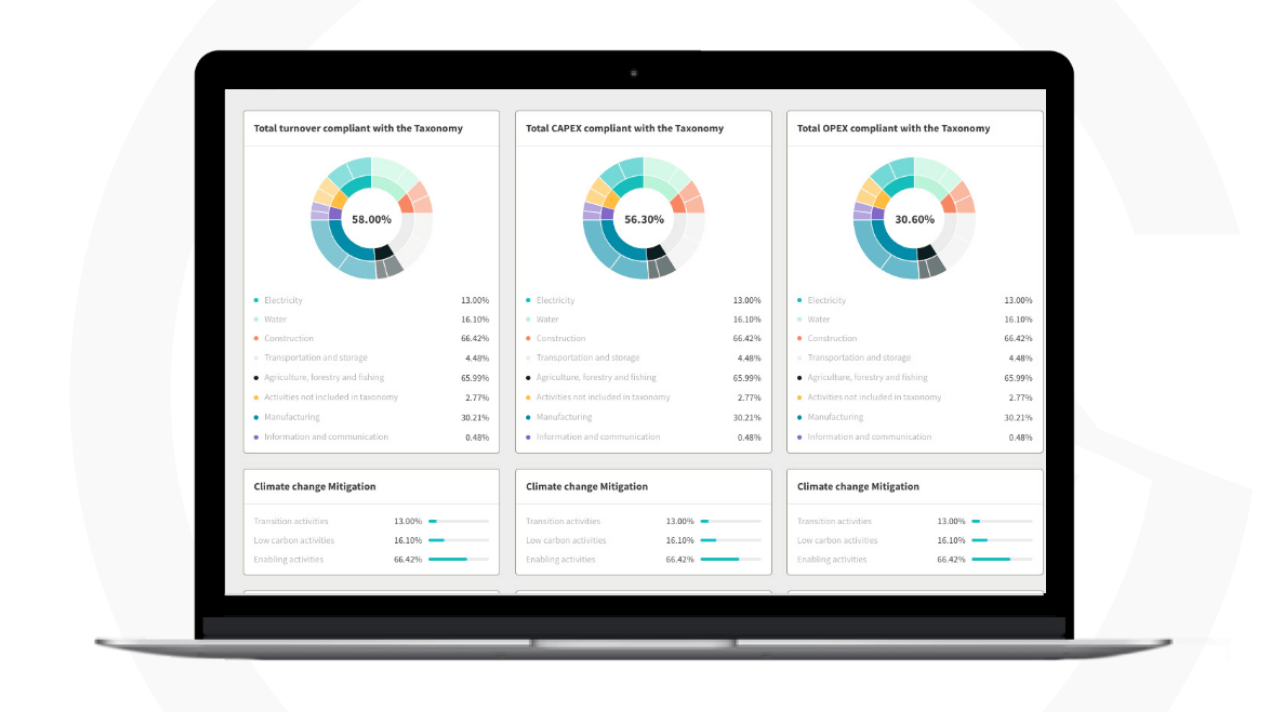

Greenomy’s goal is to be a digital tool platform that empowers companies and investors to measure their sustainability and improve their ESG factors. Companies can access, verify, and manage Taxonomy-aligned company-level ESG data.

Green Economy: The cloud-based platform will connect companies, auditors, financial institutions, and data providers and can be used for analysis, management, and reporting.

Greenomy was selected as the International Laureate of the Fintech for Tomorrow Challenge 2020, organized by Paris Europlace, and the European Discovery Fintech Startup 2021 at the European Finance Summit in Luxembourg. The company was also selected as part of the 100 most innovative fintech in the world by FinTech Abu Dhabi in June 2021. Greenomy also won The LHoFT – Luxembourg House of Financial Technology’s acceleration program Catapult Kickstarter 2021, receiving €50.000 in subsidies from the Luxembourg Minister of Economy.

The impact Greenomy hopes to include:

- Eliminating greenwashing.

- Empowering companies to improve their ESG.

- Optimizing the allocation of investments into sustainability.

- Accelerating the transition to a carbon-neutral economy.