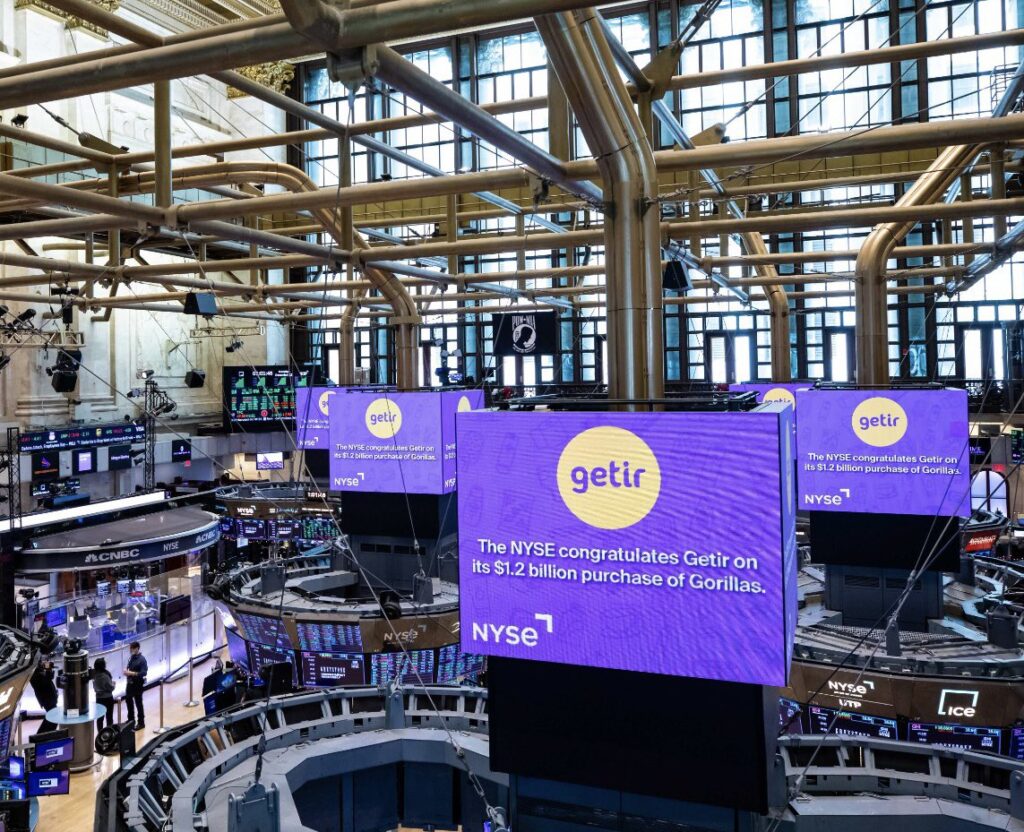

Getir has acquired Gorillas and created Europe’s first quick commerce giant. The $1.2 billion deal unites two leading companies designed to deliver groceries within 15 to 20 minutes after ordering. A very recent business, started by a few startups in the US and Europe to facilitate home shopping, peaked during 2020 and 2021, the two-year period in which the pandemic and lockdown pushed all product delivery services to the top.

A complicated business: big peaks and then the drop

The rapid arrival of many interested companies in a market that inevitably declined with the gradual return to pre-Covid life left several startups on the ground, forcing the biggest ones into forced mergers to limit losses. The deal between Getir and Gorillas is the largest in the industry. It closed on much lower figures than the $2.1 billion valuation Gorillas had obtained after its last nearly $1 billion round led by Delivery Hero in late 2021 precisely because the business has downsized so much, with companies struggling to find profitability.

Getir has the hunt for new funds among its priorities for 2023 because quick commerce involves complicated logistics and low margins, thus requiring substantial financial resources. The Turkish company was founded in 2015 by a team consisting of CEO Nazim Salur (former creator of BiTaksi, one of the leading apps used in Turkey to book a taxi), Serkan Borancili, and Dogancan Dalyan (who came from BiTaksi itself, as well as Tuncay Tutek (a former Pepsi and Procter & Gamble executive) closed a $768 million round led by the Mubadala Investment Company (Abu Dhabi sovereign wealth fund) last March, which skyrocketed the valuation to $11.8 billion, dropping to $8.8 billion in the following months.

Paying couriers, and renting space in the central and most expensive areas of cities, which is crucial to meet ultra-fast delivery times, are challenging aspects to match with profit, despite a high turnover. Added to this is the economic crisis affecting Europe, with inflation, the strong dollar and rising commodity prices forcing people to cut back on shopping and act more cautiously.

Few large companies remain

If such a feeble market is destined to revolve around a few large groups, the simultaneous emergence in 2020 of Flick and Gorillas in Berlin foretold that one of them would sooner or later make its mark. The former acquired the French company Cajoo last May, while the latter tried to make a breakthrough in early 2022 by buying Frichti, also active in France. Before them came Getir, which took over the British Weezy and now Gorillas to expand its presence in the European markets, particularly the UK and Germany, which are the largest. Gopuff, an American company valued at $15 billion in London and other major British cities, which has expanded its assets and reach with the acquisition of Fancy and Dija, is also aiming to fit in.

Acquiring Gorillas for Getir means increasing efficiency within the dark stores, the places where products are sold (online), and securing greater strength in the relationship with suppliers. However, the overlapping of dark stores and couriers in different cities will undoubtedly result in job cuts to lower the new company’s expenses and bookings that are no longer in line with the previous two-year golden age. In May, Getir announced more than 4,000 job cuts due to downsizing and declining business. Gorillas came to operate just under 200 dark stores in nine countries before the wave of redundancies and business closures announced last summer in Italy, Spain and Denmark.

The problems quick commerce causes in cities

In addition to financial difficulties and a declining business, companies in the sector have to deal with the unease of city administrations, which in many cases do not look favourably on the rapid spread of dark stores in central areas, a compulsory step to allow couriers to deliver food within a matter of minutes of booking. The comings and goings during the day of trucks to supply the stores, the unloading that blocks the transit of other vehicles in the street, and the scooters and bicycles of couriers clustered outside the structure waiting for delivery have transformed the face of the neighbourhoods concerned and increased environmental and noise pollution, provoking a reaction from residents.

This has sparked a battle in Paris between the administration and the quick commerce companies, with the former interested in moving them away from central areas and the latter against the move. After reducing the maximum speed of electric bicycles in courier dowries to 25 km/h, Amsterdam Flink, Getir and Gorillas are under scrutiny by the administration, which last January blocked the opening of new dark stores, taking a year to analyse the issue and find the proper countermeasures.

“For their business model, dark stores have to be close to their customers, so many of them are located in residential areas, but our streets are not equipped to handle them. They tend to be small and unable to stock many products, so they must be restocked frequently. That’s why many people who live near dark stores complain. The municipality is responsible for ensuring that our residents have a good place to live,’ said Hanneke Enderveen, Amsterdam’s urban policy advisor. In mid-November, a closure notice was triggered for three warehouses (one by Getir and two by Flink), with companies in some cases attempting to turn the dark store into a supermarket. They are finding approval from the administration.

Demands will grow, but is it worth it?

According to analysts’ estimates, the last-mile food and grocery delivery market will continue to grow, with revenues exceeding $70 billion in 2025. “Markets go up and down, but consumers love our service and convenience is here to stay. The super fast grocery delivery industry will steadily grow for many years to come and Getir will lead this category it created 7 years ago,” said Getir CEO Nazim Salur about the Gorillas acquisition.

In the face of the many dynamics and issues produced by the industry, the question remains whether quick commerce is a business that can endure and be profitable, knowing that the convenience provided by fast delivery entails disadvantages and contributes to urban decay.