From Bitcoins to stocks, with investments accessible for all Bitpanda has broken the dominance of traditional finance

Austrian startup makes its way into European markets and has antibodies to cryptocurrency volatility.

When talking about European startups, we tend to consider mainly realities circumscribed to certain countries, leaving the others only in the background. Among the exceptions that negate the divide is Bitpanda, a company founded in 2014 to enable everyone to invest in cryptocurrencies, stocks, and metals, starting with small amounts and taking advantage of broad freedom of movement on an easy-to-access and easy-to-manage platform.

One of the most significant merits of the startup founded by Paul Klanschek, Christian Trummer, and Eric Demuth, all three under 30 at the time, is putting Austria, a country known abroad primarily for its mountains, classical music, Strudel, and lifestyle that places the capital Vienna among the world’s best cities to live in, on the innovation map. Intuition aimed at facilitating the acquisition of Bitcoin at a time when the leading digital currency was known to a few devotees of the subject turned several spotlights on Bitpanda, which in six funding rounds raised just over $546 million and ended up being valued at $4.1 billion. Enough to represent a winning model that has ‘forced’ institutions and significant national groups to assess potential and support innovative startups.

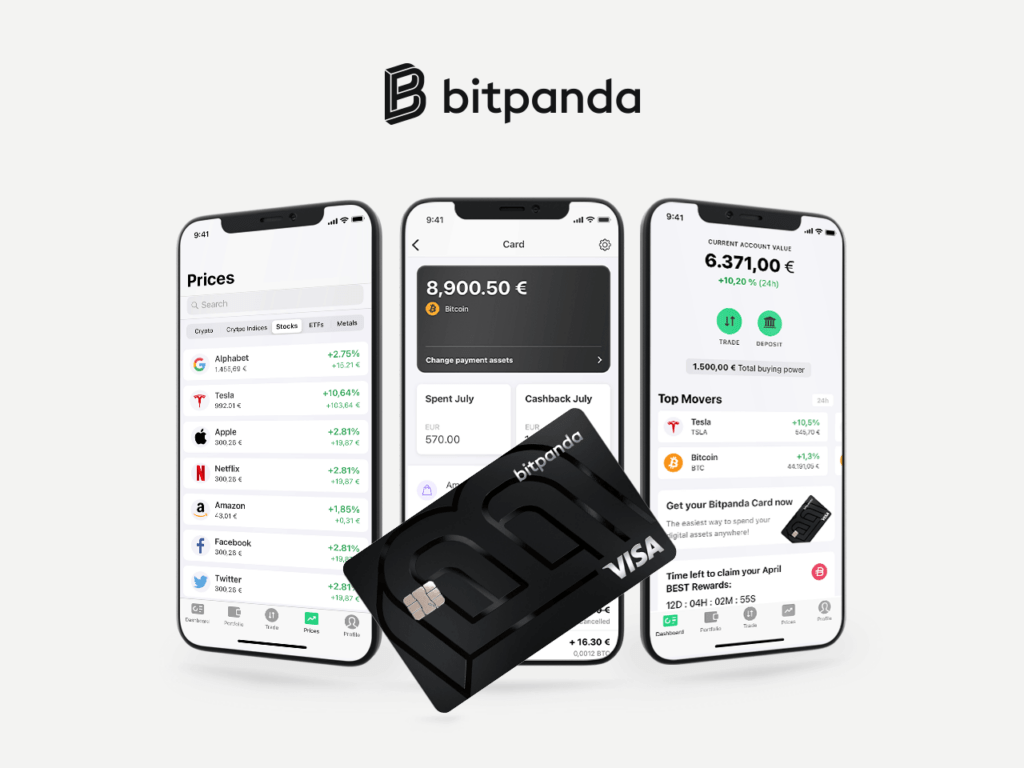

With the Covid-19 pandemic forcing the world to come to a standstill and leaving millions of people with less money available than in the past, Bitpanda was able to ride the excellent momentum by establishing itself as a platform capable of facilitating those who were willing to invest small sums of money, because you can start even with 2 euros. And it is with the arrival of fractional shares, that is, the possibility of buying a part of a share of the most popular companies on the market (Apple, Adidas, Tesla, Coca-Cola, Amazon, PayPal, and many others because the list includes more than a thousand assets to invest in), that the Austrian startup accelerates by imposing itself even outside the domestic market.

A series of valuable accuracies for those with investment projects but limited financial resources to get created. “In the beginning, the idea was to equate the process of buying Bitcoin with buying an object online, then users asked us to provide them with a wallet for other cryptocurrencies, and at that point, we thought it was time to bring to digital all the peculiarities of the traditional financial world, which unlike our platform is designed for the rich and to leave bad deals to those who do not have much money.”

So much so that it has landed in many continental markets and even in the U.S., opened offices and Innovation hubs in eleven European cities, expanded the team to more than 1,000 employees (600 of whom are operating in the new Vienna office), and launched a series of services including the Bitpanda Card, a debit card linked to the Visa payment system for withdrawing cash or making purchases online and in physical stores, spending any asset between cryptocurrencies, metals, and stocks available in one’s Bitpanda wallet (with the chosen asset being converted into euros and deducted from the account).

Offering a single digital space to converge different investments has been instrumental in Bitpanda’s growth. However, to attract and retain users, one must stimulate them and encourage their first attempts. Eliminating per-investment fees was a forward-looking first step, as was operating within the financial regulations in the various countries.

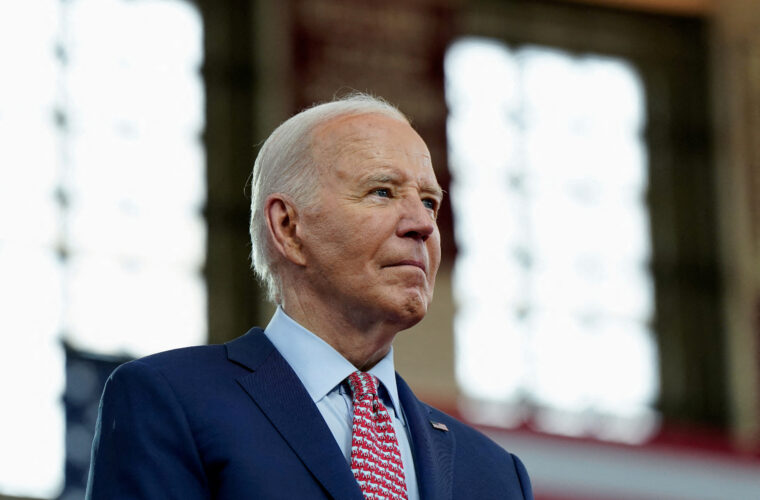

“The difference with other companies is that we offer a safe and regulated service, which we developed ourselves step by step. We are not interested in speculators, but rather in those who aim for medium- and long-term investments,” says Demuth, Ceo of Bitpanda, whom we met in his office on the fifth and top floor of the company’s Vienna headquarters, which is located across the street from that of OMV, Austria’s leading oil company. “We are no longer just a cryptocurrency company; rather, we are aiming to engage the mainstream audience, and the results prove us right: today, there are more people in Austria with a Bitpanda account than those who invest in stocks, proving that if you offer a useful, effective and affordable service, people appreciate and try it.”

This kind of vision has enabled Austrians to look beyond the more subject-sensitive target audience, bringing people into the world of investing who until recently were not interested in doing so. “Our typical customer is not only under 60 or over 20 but all people who are used to handling money online and using credit cards. That’s why there is also a good segment of the female audience, which has been growing sharply over the past two years. If before more than 90 percent of our customer base was male, now the distribution is 70 percent men and 30 percent women.”

Betting on a market closely tied to the volatility of its assets is a potential gamble. Still, projecting the gaze into the future, the flops of some digital currencies, criticism of the system, and side effects related to the use of crypto by criminals are not a problem for Bitpanda. “We have been accustomed for years to the roller coaster of the crypto market, with extreme highs and lows that show a clear signal: every time records are touched in either direction, the market becomes more stable. This is also why we have no fears in case of negative events because we have sufficient cash reserves to cope with any scenario and continue with our growth strategy.”

However, broadening the scope to the entire industry, there are limits to be corrected for the future: “There are too many useless cryptocurrencies compared to about 20 that are good solutions right now. Although we know that more good projects will come later, improving the market.” The abundance of properties that are suspect or otherwise far from promising in the medium and long term forces one to reason and figure out where to invest. Here are two significant indications from Bitpanda and Demuth: the Academy and the long-term view.

In the first case, intending to bring as many people as possible closer to the platform, the Austrian startup has planned a training course divided by levels (beginner, intermediate, expert) to explain basic concepts of financial education because learning how to manage one’s money should be a priority for every individual. Without this step, is the widespread belief at Bitpanda that it is as pointless as it is risky to throw yourself headlong into the index of equities or crypto options chasing the big score. “If you are not familiar with interest, fees, inflation, fractional shares, dividends, funds, EFTs, and bonds, it is improbable to invest your money well unless you want to speculate,” Demuth explains.

The 35-year-old head of the startup is evident in his mind about how a good investor should and does move. However, establishing general rules that always apply to everyone is nearly impossible. “You have to start with what it means to invest and make an investment because there are those who understand it as an attempt at a short-term gain and those who understand it as a long-term targeted move, born after finding their strategy. This is the determining point because people must be taught that everyone must find the path that best adheres to individual needs. It takes time to do that, especially if you don’t have the right experience in the field.”