The aim is to reduce Europe’s dependence on Asia

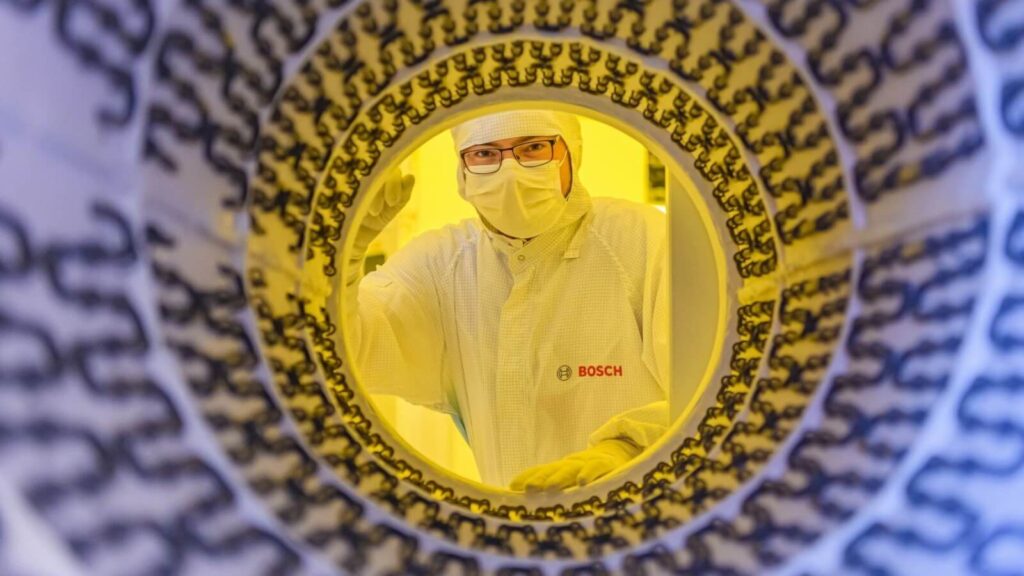

Bosch: A three billion euro plan in semiconductor production to double Europe’s share of the global scale from 10% to 20% by the end of the decade. After Intel’s plans, Bosch, aiming to bring Europe back into the limelight, always focused on Germany as the locomotive country. The plan of the German multinational founded in Stuttgart in November 1886 was to exploit funding from the Berlin government and the EU under the IPCEI (important projects of common European interest) framework to strengthen microelectronics. Stefan Hartung, Chairman of the Bosch Board of Management, described it as ‘the key to tomorrow’s mobility, to the Internet of Things and to Technology for Life, so in essence a crucial factor for success in all areas of the business.’ Bosch’s announcement is a significant act for the continent’s future, which is called upon to find solutions to alleviate its dependence on the USA and Asia.

On Bosch’s road map is constructing two new development centres at the cost of more than 170 million euros, to be built in Dresden and Reutlingen, a city 40 kilometres south of Stuttgart. A further 250 million euros will be earmarked for the expansion of the existing factory in Dresden, with an extension of around 3,000 square metres to be completed during 2023. ‘Europe can and must invest in the semiconductor industry,’ said Hartung. “Never before has the goal been to produce chips for the specific needs of European industry. And that means not just producing chips with extremely small dimensions”. The intention is to produce electronic components used in the automotive industry, with semiconductors between 40 and 200 nanometres. At the same time, other plants will partly focus on chips for household appliances, eBikes, and wearable devices.

By virtue of agreements with numerous global automotive companies, Bosch will focus on developing and improving specific parts, such as the radar sensors used by vehicles to perform 360-degree scans of the surrounding area during autonomous driving. The intention is to upgrade these components, to make them even smaller, smarter, and more convenient, relying, for example, on a new projection module small enough to fit into the temple of a pair of smart glasses. Steps facilitated by the 1-billion-euro factory inaugurated by Bosch in June 2021 allow modular production.

Bosch’s intention is to focus heavily on electrification both to change the automotive industry and to move closer to climate neutrality. But also on another strategic element. “Electricity-based solutions have priority, but hydrogen-based solutions must also gain momentum. We will need both if we are to live sustainably on our planet,’ said Hartung during the presentation of the annual results last May. With this in mind, Bosch has planned investments of 3 billion euros over the next three years in technologies to reduce climate impact, not least because global turnover for the electrolysis components market is expected to reach 14 billion euros by 2030.

Although the current moment is one of profound instability on a global level, with primary sectors such as technology, mobility, and automotive grappling with difficulties and production slowdowns, Bosch is ready for several maxi investments, thanks to the excellent performance of the last period. In the fiscal year 2021, sales rose to EUR 78.7 billion, marking a growth of 10.1 percent. Sales in all regions were positive: +8.9% and 41.3 billion euros in Europe, +6.5% and 11.4 billion euros in North America, +32% and 1.4 billion euros in South America, and +13.5% and 24.5 billion euros in Asia-Pacific.