“The weak will perish, and the winner will take all.” This was just the premise of ‘Squid Game,’ a global megahit drama series on Netflix that came out last year. At that time, the Korean OTT market was red-hot as new investments poured in. But only a few months later, the market players face their own survival game.

Reshuffling Has Begun

The first signal of market reshaping broke in July. ‘Whatcha’, a Seoul-based service that has about 1 million MAU(Monthly Active Users), began drastically downsizing its operation. The company is undergoing a voluntary redundancy program, during which it would let go of about half of the employees.

Whatcha’s once-ambitious business expansion plan, ‘Whatcha 2.0’, have completely suspended just five months after its announcement. What have you originally planned to move into webtoon and music business? “Going into the new market means pouring a lot of money,” a person familiar with the matter said to 4i magazine, “And Whatcha simply cannot afford it, as it has failed to get pre-IPO(pre-initial public offering) investment.” What have you tried to get 100billion won(about 75 million dollars) worth of investment earlier this year with no success? With money dried up, the company is trying to reduce spending to meet its break-even point.

KT, a telecom giant, has also thrown the towel in owning OTT service. KT has decided to hand over its platform ‘Seezn’ to CJ ENM, the country’s most important content and entertainment company, in return for 100billion won investment from CJ ENM to KT’s subsidiary company. Seezn is to be merged with CJ ENM’s ‘Tving,’ creating the largest domestic OTT platform with about 5.3 million users in total. The two companies plan to complete the merger process by December.

RIDI gained its unicorn start-up status with its e-book and webcomic content platform earlier this year. More OTT platforms are expected to be on the market for the rest of this year. According to a local report, RIDI is also looking into selling ‘Laftel,’ an OTT platform specializing in streaming animation.

Once Were Booming, But…

This Korean OTT market landscape is opposite of what it was until the end of last year. Back then, each platform was spearheading expansion, braving a snowballing deficit. They also were betting on content, which made the cost of everything involved -casting celebrities, getting story copyrights, and general operation- skyrocketed.

With such context, not a single domestic OTT company has generated revenue in Korea. Venture capitalists kept throwing money at OTT platforms. Tving faced a 76.2 billion won worth deficit in 2021, which was 12.4 times higher than the previous year. Wave, SK Telecom-affiliated OTT platform, made an operating loss of 55.8 billion won. Whatcha made a 24.8 billion won deficit. But the market was booming because the demand for OTT contents kept growing with Covid19.

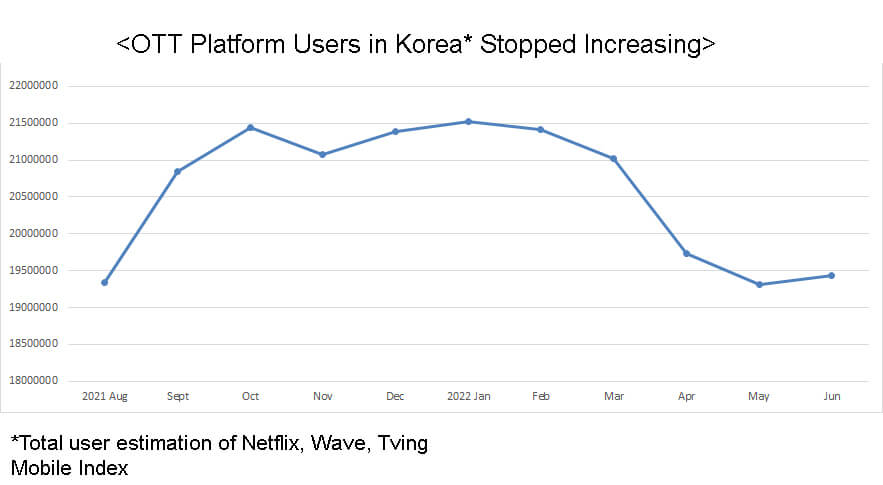

Then came the end of social distancing measures. And almost every factor that once boosted OTT platforms became revenue growth headwinds. The South Korean government has lifted its social distancing rules since April. As people step out of the house, the demand for platforms has slowly cooled. But the platforms still need a lot of money to keep on, which is why many OTT companies are cornered into a crisis, especially with the capital market slowdown.

Would ‘Strategic Deficit’ Plan Work?

Some large companies, such as CJ ENM and SK Telecom, plan to continue investing in the OTT business. For them, the current market situation is more favorable because it opens more chances for them to win while other smaller companies fall.

However, it is questionable if such a ‘strategic deficit’ plan will lead to a big win. Dramas, films, and variety shows have one thing in common; no one can guarantee the success of the content before it hits the market. For instance, Squid Game was a huge hit. But there’s no way of telling if Squid Game 2 would also be popular.

OTT businesses also have a weakness in keeping the subscription flow. The more OTT platforms there are, the more users jump from one to another. They would stop subscriptions after signing up for a month or two for a specific show. According to Korea Creative Content Agency, Korean OTT users subscribe to an average of 2.7 OTT platforms. About 53% said they changed their subscribing platform according to specific content.