Prommt is revolutionizing remote payments for enterprises and clients

Easy online payments are essential in an age of e-commerce and digital transformation. Founded in 2017, Prommt is a successful platform revolutionizing remote payments for enterprises and their clients. Its innovative solutions enable fast, frictionless card and open banking payments.

Based in Dublin, Ireland, Prommt is used by businesses across Europe and the USA today. It is an enterprise-grade solution built for teams, supporting multiple locations and out in the field, with reporting and alerting capabilities.

We discussed with Donal McGuinness, CEO at Prommt, to better understand how this payment platform operates. He shared with 4i Magazine his insights on the banking system and services.

He studied Computer Science at DCU and Telecommunications Engineering at DIT and spent the early years of his career in the telecommunications industry. His experience in mobile payments dates to 1999, when he founded his first mobile payments company, ItsMobile. Donal was also a Non-Executive Director of the Irish Internet Association from 2009 to 2011 and a movie distribution business from 2002 to 2020.

In 2016 Donal joined a silicon valley startup in the identity verification space called Danal inc. He set up and grew the global business outside of the USA as General Manager of EMEA until 2019, when Boku Inc acquired the company for USD 112 million. Donal joined Prommt as CEO in 2019. He is an innovator and is passionate about payment innovation.

First, tell us a little about Prommt and what kind of solutions it offers

Founded in 2017, Prommt is a payments request platform revolutionizing remote payments for enterprises and their clients. We enable businesses to reduce costs and protect margins by converting remote payments, such as over-the-phone payments, into an easy, secure, and more convenient way to pay via card or instant account-to-account bank transfer (Pay By Bank) that leverages open banking capabilities.

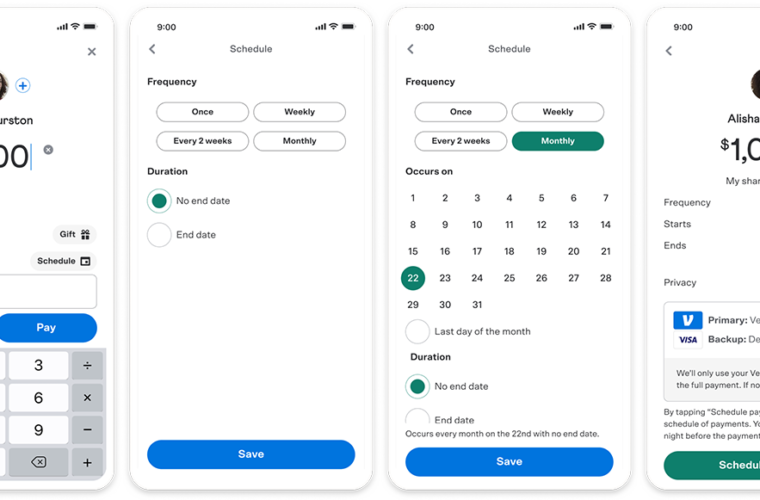

Prommt is perfect for businesses that cannot easily transact online because the product or service needs to be more bespoke or custom to lend itself to self-selection. It is particularly relevant for luxury retail, hospitality, automotive, builders, merchants, and professional services sectors. Our solution lets them offer online personal consultations and follow up with 3D secure, merchant-branded payment requests sent through SMS, email, or web chat. With a range of payment orchestration capabilities, the ability to accept payment through card or open banking transfer in multiple currencies, store cards for repeat purchases, and set up recurring payments and the group sends – Prommt is much more than a basic pay-by-link solution.

Industry leaders such as Bulgari, Arnotts, Brown Thomas, Cambria Motors PLC, Harvey Norman, Adare Manor, Ballyfin Demense, a top Premier League football club, and many others use Prommt to drive profitability by significantly reducing card fraud and chargebacks, minimizing payment administration, and delivering remote buying experience that reflects their brand identity.

Why do you believe luxury retailers must adopt open banking to save costs and meet consumer demand?

A luxury purchase is as much about the shopping experience as the product itself. Luxury retailers often rely on phone consultations and web chats for more personal shopping assistance to guide customers through their buying journey or to take a deposit. Similar to e-commerce transactions, these purchases demand a frictionless, flexible, and secure payment experience that doesn’t detract from the joy of shopping while protecting the customer and merchant from fraud. With open banking, retailers can significantly reduce costs by eliminating card processing fees and safeguard their high-value transactions against fraud by eliminating chargebacks. 25 per cent of global luxury goods sales will be online by 2025. Adopting open banking APIs is expected to reduce fraud by up to 61% by 2024.

The elimination of the need to enter the IBAN information offers a slick payer journey. While traditional card payment methods can come with high transaction fees, open banking streamlines the payment process with a direct link between customer and merchant accounts, often resulting in near real-time payments. The customer is brought to a pre-populated payment flow enabling them to pay from the comfort of their mobile device and the familiarity of their online banking app for authentication.

Another factor to consider is the arrival of luxury’s new generation of hybrid shoppers and their expectations. Millennials and Gen-Z currently account for approximately 50 per cent of luxury sales across the globe; this figure is expected to exceed 70 per cent by 2025. Growing up with technology, this cohort demands a uniform, seamless brand experience with personalization and comfort extending to their remote checkout experience. By investing in today’s technology, like open banking payments, retailers can meet consumer expectations and better adapt to tomorrow’s market fluctuations.

How can fintech solutions help brands to adapt consumer behaviour?

Consumers today crave convenience and seamless payment experiences, as they routinely transact online and are familiar with 3D security and authentication. I believe that optimizing payment success rates comes down to making it as easy as possible for customers to pay. At Prommt, we’re reintroducing the human touch to what has been a traditionally cold remote payment experience. This implies ensuring a seamless process, even when things are unexpected.

Prommt’s Payment Orchestration controls are cost-efficient and ensure optimum payment success rates. They have accelerated customer adoption through a range of payment orchestration tools that subtly nurture the customer to pay by the bank by setting value thresholds for transactions and presenting a combination of card and/or bank checkouts, depending on the value of the transaction. For example, one of our clients is one of the largest independent auction houses in the UK; they have been using our card-based payment requests for several years and recently launched open banking payments with Prommt in late 2022. Within just a few months, they now drive 85 per cent of their remote payments through Pay By Bank, with just 15 percent paid by card.

Similarly, merchants can easily switch the default payment setting from card to bank, encouraging customers to pay via bank transfer vs card when using Prommt. The card option will still be available, but as the second option, customers are more likely to select the Pay By Bank method, reducing card fees and decreasing payment settlement times. Customers are embracing open banking as it’s easy and quick, and they no longer need to go through a cumbersome payee setup via Internet banking.

Many experts believe that open banking benefits several verticals since the average value of an open banking payment is twice that of cards. What do you believe?

I agree 100 per cent. In fact, we are seeing four times the value of card payments. Our clients from several key sectors have adopted Prommt’s Pay By Bank as a primary payment method since its launch in mid-2022. These clients processed close to £30 million in the UK and Ireland in just a few short months, growing at approximately 20 per cent per month. We are seeing strong engagement within a mix of verticals, including automotive, builders, merchants, luxury retail, and hospitality. Some of our key findings based on client adoption include the following:

-The average transaction value (ATV) for a Pay By Bank transaction (£2,390) is almost four times higher than the ATV for a card transaction (£675).

-The highest value transaction through Pay By Bank so far has been a car purchase for £54,000, and within luxury retail was £34,000, both driving huge savings for the merchants through reduced transaction costs and faster payments settlement.

-Pay By Bank is replacing cumbersome, manual bank transfers and some larger card transactions. Eliminating card processing fees for high-value transactions reduces payment operations costs and offsets the threat of further increases in card fees.

-Cost reduction and fraud prevention are key drivers for the accelerating adoption of Pay By Bank.

-Prommt has a set of orchestration controls that enable merchants to set value thresholds for transactions and present a combination of card and/or bank checkouts, depending on the value of the transaction. Merchants have been able to seamlessly nudge customers toward Pay By Bank for larger transactions without any impact on conversion.

Overall, open banking enables merchants to protect margins, which is particularly relevant in a challenging economic climate. In addition, it offers an easier, more streamlined process of accepting bank payments compared to manual bank transfers, resulting in a further reduction of operational overhead.

We recently had the collapse of Silicon Valley Bank, which caused intense concern and fears of a domino effect. Based on your expertise, what is the current state of the global payments and banking industry?

The SVB collapse and the aftermath experienced by other banks have been quite a shock. However, I can clearly separate the payments industry from the banking industry. Payment is a transport system. It’s the movement of money from A to B. Banking is the A and the B. It’s where the money is stored. Even before the SVB collapse, we saw our customers (especially the larger enterprises) being very conservative about who handles their cash, and that hasn’t changed. Businesses still need to get paid and, in turn, make payments, so life goes on.

However, the resulting reduction in venture capital activity in fintech will certainly result in some liquidations and distressed sales of early-stage innovative fintech companies. That could be better for the fintech/Playtech industry. I see tighter regulation of banks and eMoney institutions (EMIs) within the banking industry. This will potentially stifle innovation and only suit the larger incumbent banks and payment processors.