By Jaspreet Singh

(Reuters) – Bumble beat Wall Street estimates for first-quarter revenue on Wednesday helped by growth in its paying users, sending the company’s shares up more than 9% in aftermarket trading.

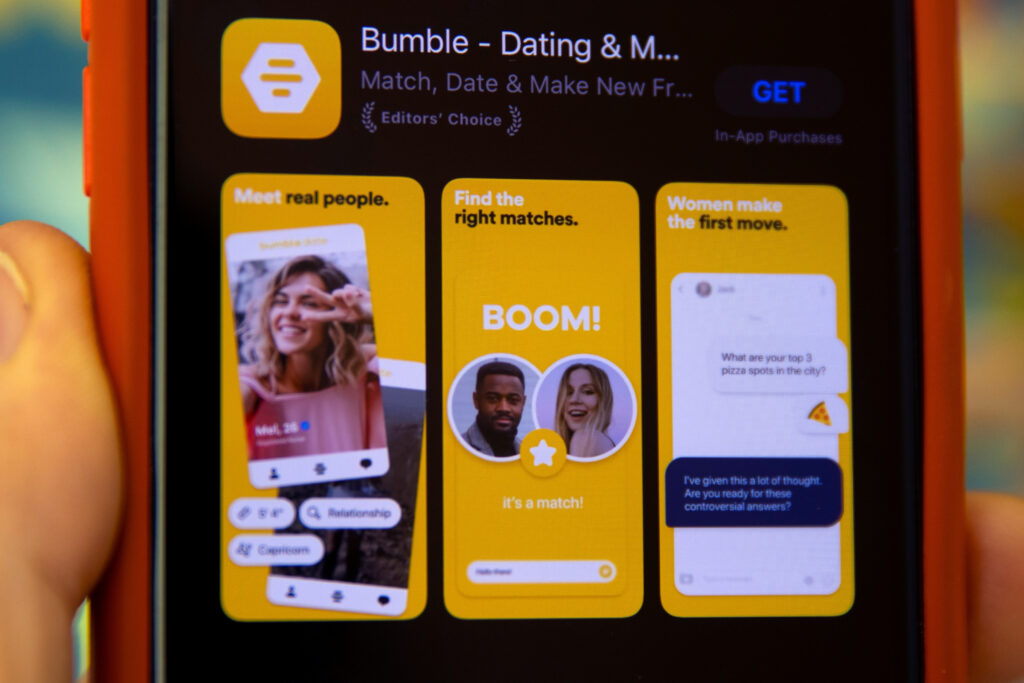

The company, which offers dating apps such as Bumble, Badoo, and Fruitz, has benefited from its marketing efforts to tap younger users and women.

Last week, Bumble unveiled its anticipated app refresh, with a new logo, a move announced in February, that includes new features such as allowing women to set a question that their potential match could respond to.

“We plan to roll out more experience-focused features this year to help our community better navigate the modern dating scene,” CEO Lidiane Jones said.

In the first quarter, global Bumble downloads growth rose 18% from a year earlier, according to market intelligence firm Sensor Tower.

“I think this outperformance in Q1 demonstrates Bumble’s ability to drive domestic and international growth within its core Bumble brand against the backdrop of recent management changes and a difficult macroeconomic environment for online dating,” M Science analyst Chandler Willison said.

The Austin, Texas-based company’s first-quarter revenue rose 10.2% to $267.8 million, beating analysts’ average estimate of $265.5 million, according to LSEG data.

It reported earnings per share of 19 cents, compared with analysts’ estimate of 7 cents per share, according to LSEG data.

Total paying users across Bumble’s apps increased to about 4 million in the first-quarter ended March 31, from 3.5 million a year earlier.

Bumble expects second-quarter revenue between $269 million and $275 million, below analysts’ estimate of $278.6 million.

Citi analysts said in a note on Wednesday that while the second-quarter forecast was below expectations, investor sentiment was low enough to look past that as Bumble maintained its full-year outlook.